Now What?- The Balanced Scorecard Goes to Moldova Pt. 3

In part two of this series, we followed the microfinance institution as it learned the importance of having an effective mission statement. After drafting and agreeing upon a mission statement, everyone leaned back in their chair and seemed to be content with what they had just done. Eventually, after a few minutes went by, one of the board members asked, "acum ce?" This is Romanian for "now what?"

Now what?

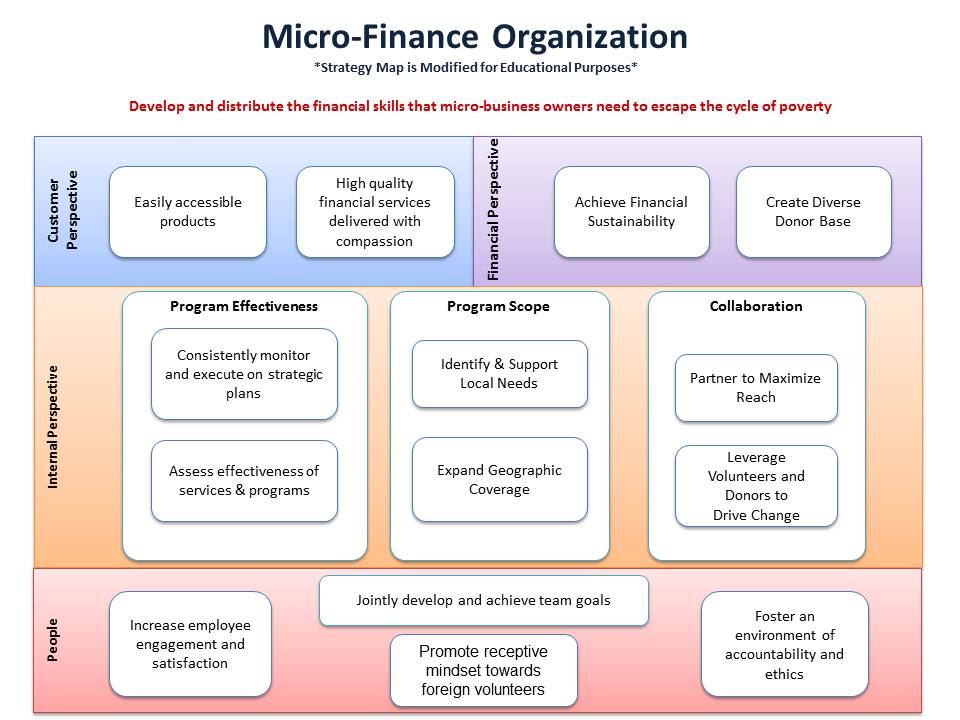

The organization now had a destination to strive for, but it needed a plan to get there. This is where the strategy map comes in. By linking key objectives, a strategy map depicts how the organization plans to accomplish its mission. For most organizations, the strategy contains objectives that fall into four main categories; customer; financial; internal; and learning and growth. Prior to this process, a majority of the objectives for the microfinance institution fell into the financial category. The challenge was to step back and develop objectives that create a more balanced blueprint for attaining the mission.

Objectives

During the communist era, everything was controlled by the government and, as a consequence, there was no competition within the market. Due to the lacking competition, there was never a need to think strategically. After this mental hurdle was overcome, the organization began to develop the objectives that would become the basic building blocks of their strategy. In order to keep the process simple, the organization went through each of the categories and followed the typical format for creating objectives: Verb + Adjective + Noun. After much deliberation and many questions, the microfinance institution had a set of fourteen objectives that everyone agreed upon. Below is a modified version of the strategy map that has been genericized for the purpose of this blog.

You can't manage what you can't measure

With your mission as the destination and your strategy map as a guide, it is now time to start achieving. The question is, "how do we know if progress is being made, and how do we manage that progress?" The answer is measurement. Each objective must be linked to a measure, or multiple measures, that come together to form a system of cause-and-effect relationships.

At first, the microfinance institution wanted to measure anything and everything. However, especially for a small organization such as this, having too many measures can be overwhelming. It is best to narrow down the total number of measures, so that you have specific, actionable measures that directly correlate to each objective. Developing specific targets for each measure will then establish the level of performance that is required over time. Whether or not the organization is reaching these targets will determine if progress is being achieved, or if adjustments should be made.

Initiatives

The measures have been defined and the targets set, acum ce (now what)? How will we meet these targets and achieve our objectives? Projects now need to be set in place that move the organization towards the goal. These projects are known as initiatives. The microfinance institution began spitting out a multitude of projects. Some of them were directly related to the strategy, others had been on the "things to do" list for years. The organization must now be disciplined and gather only the initiatives that are aligned with the strategy and were critical for success. This was a tough process, but it was key in guaranteeing that all resources were being used in a way that progresses the organization towards the mission.

The microfinance institution had established its mission and the strategy for accomplishing it, now it was time to act. The organization has planned to reconvene in a month for its first strategy review meeting. Stay tuned for the final post in this series to see their progress and discuss the characteristics of an effective strategy review meeting.

June 2021

| S | M | T | W | T | F | S |

|---|---|---|---|---|---|---|

| 1 | 2 | 3 | 4 | 5 | ||

| 6 | 7 | 8 | 9 | 10 | 11 | 12 |

| 13 | 14 | 15 | 16 | 17 | 18 | 19 |

| 20 | 21 | 22 | 23 | 24 | 25 | 26 |

| 27 | 28 | 29 | 30 |

Monthly Archive

June 2014 (1)

May 2014 (2)

March 2014 (1)

February 2014 (2)

January 2014 (1)

December 2013 (1)

October 2013 (2)

September 2013 (1)

July 2013 (2)

June 2013 (2)

April 2013 (1)

March 2013 (3)

February 2013 (4)

January 2013 (7)

December 2012 (4)

November 2012 (8)

October 2012 (9)

September 2012 (5)

August 2012 (6)

July 2012 (5)

June 2012 (7)

May 2012 (8)

April 2012 (5)

March 2012 (5)

February 2012 (6)

January 2012 (6)

December 2011 (7)

November 2011 (9)

October 2011 (9)

September 2011 (2)

August 2011 (8)

July 2011 (6)

June 2011 (8)

May 2011 (12)

April 2011 (5)

March 2011 (1)

February 2011 (2)

January 2011 (4)

December 2010 (6)

November 2010 (3)

October 2010 (5)

September 2010 (4)

August 2010 (3)

July 2010 (2)

June 2010 (1)

May 2010 (2)

April 2010 (1)

March 2010 (3)

January 2010 (4)

December 2009 (1)

November 2009 (1)

October 2009 (1)

September 2009 (3)

August 2009 (2)

July 2009 (3)

June 2009 (3)

May 2009 (6)

April 2009 (5)

March 2009 (3)

February 2009 (2)

January 2009 (2)

December 2008 (2)

November 2008 (2)

October 2008 (4)

September 2008 (6)

August 2008 (5)

July 2008 (4)

June 2008 (9)

May 2008 (5)

April 2008 (6)

March 2008 (8)