Successful strategy management and execution requires effective strategy review meetings. More specifically, success begins in the week prior to a strategy review meeting. Unfortunately, this is an area where many organizations struggle.

Agendas are often poorly defined. Factions within an organization may use meetings as a chance to compete for budgets or re-fight old battles. Some organizations can even see their meetings devolve into endless rounds of discussion and speculation, rather than a chance for leadership to make clear, disciplined strategic decisions based on the available data.

To keep your meetings focused on strategic choices, your organization should follow a clear progression of steps in preparing for each strategy review meeting. Important tasks are outlined below in a five day progression. But you know your organization best – if it should be 10 days instead of five then take that time to do it right for your team and culture.

5 days before the meeting:

Successful preparation begins with measure owners updating their information to reflect the organization's latest results for each performance measure. The measure owners then update their measure analysis, recommendations, and statuses (red, yellow or green) to reflect the latest data. Initiative owners update their information in a similar manner. Milestones, budget information, and status are updated to indicate how the initiative is performing.

4 days before the meeting:

Based on the data and analysis provided by the Measure Owners and Initiative Owners, Objective Owners then update their analysis, recommendations, and status to indicate whether their objectives are fulfilling the organizational mission. Objective Owners should keep their analysis focused on the key issues and problems related to the objective. Sometimes this means relying on information that is outside of the initiative and measure data and requires discussion and problem solving across functional and organizational boundaries.

After the individual objectives are updated, the Scorecard Owner reviews the overall scorecard and determines if there are any key issues that will need to be addressed by leadership. This is where potential issues are investigated, interested parties briefed, and any potential errors are corrected.

3 days before the meeting:

The Scorecard Owner discusses any issues with the organization's top leader. With a clear view of the entire strategy, together they make a decision about where to focus their time during the strategy review meeting. In essence, they set the agenda for the meeting based on the current issues. Once this decision has been made, the Scorecard owner should go back to the specific Objective owners and ensure that they are briefed and prepared to discuss their objectives in the strategy review meeting.

2 days before the meeting:

The Scorecard Owner sends out an informational packet in advance of the meeting. This packet has a clear agenda of the items to cover, any decisions to be made, and makes sure that the key players understand the issues and decisions that need to be addressed. This is an important way to set expectations and ensure that there are no surprises.

1 day before the meeting:

The Scorecard Owner meets with the top executive once more to pre-present the information to be discussed the next day at the meeting. This is an opportunity to help set expectations, alert the executive to any challenging discussions or issues, and get provide feedback on how to proceed during the meeting.

Don't Forget

This process ensures that owners and data analysts remain accountable for the strategic elements they own, that there is accurate data and analysis going into meetings, and that the team is well prepared to focus solely on making strategic choices within the actual meeting. A week or more of prep work pays handsomely when the leadership team can focus on strategic decision making.

In addition to the process laid out in this 5-day pre-meeting schedule, Owners also need to talk with vested interests prior to the meetings to discuss potential problems and ensure that no one is surprised by the data. Before moving forward, it's important to have accurate data that everyone agrees on – this will keep people from questioning or undermining the overall strategy, or delaying the implementation of new action steps.

The meeting facilitator also needs to ensure that meeting minutes give a clear record of decisions, action items assigned between meetings, clear expectations, and due dates. This makes it easier to help the top leadership ensure that everyone involved is well prepared for the next meeting. These minutes should inform the priorities that get discussed in the next meeting. No matter how large or small your organization, preparation, accurate decision making, and follow through are critical to success.

Final Note

Because solid preparation within the leadership team is so critical to successful strategic review meeting success, we highly recommend using experienced facilitators to guide your first few meetings. The facilitator can build a successful reporting schedule, ensure leadership is prepared, and then maintain follow-up as your leadership team becomes comfortable with a mission driven agenda. Most organizations only require a professional facilitator for the first few strategy review meetings while expectations and good habits are solidified. After that, most leadership teams know what to expect and can continue effective preparation, review and decision making, and follow up on their own.

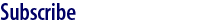

The Balanced Scorecard system typically uses a baseline, regular measurement and tracking against a target. Actual control charts might not be ideal for your Scorecard, however, the theory is still valuable

The Balanced Scorecard system typically uses a baseline, regular measurement and tracking against a target. Actual control charts might not be ideal for your Scorecard, however, the theory is still valuable